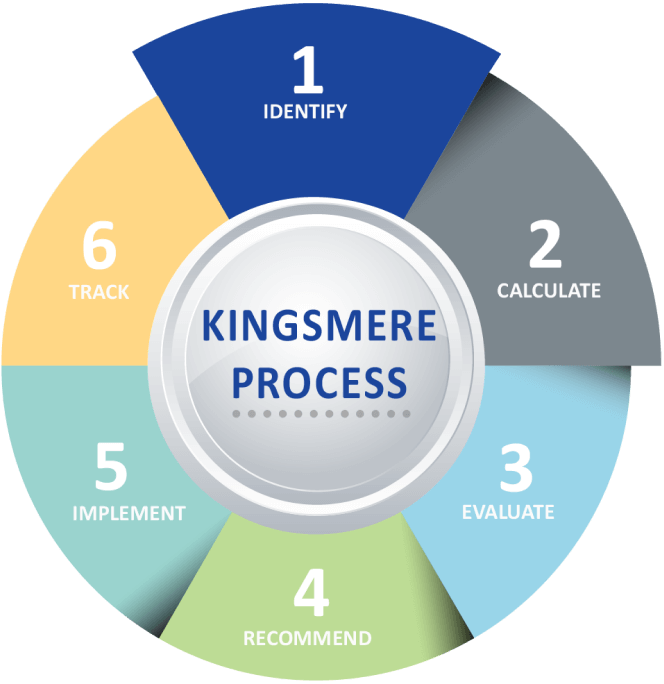

How we do it

Advice Process

01. Identify

- Identify and prioritise your financial goals.

02. Calculate

- Calculate how much is needed to reach each goal.

03. Evaluate

- Evaluate your current asset allocation.

- Evaluate your existing investment and risk products.

04. Recommend

- Recommend investment managers e.g. low-cost ETF managers.

- Recommend the best life, disability, and critical illness products.

- Recommend tax efficient products and solutions.

05. Implement

- Implement and manage the recommended products by yourself (DIY) or let me do it for you.

06. Track

- Start tracking your goals on an ongoing basis.

The Next Step

Let's Talk

Book a 30-minute consultation with our Financial Advisors to assess your requirements. Once our team understands your requirements, we are able to provide you with a strategy on how to achieve your financial goals.